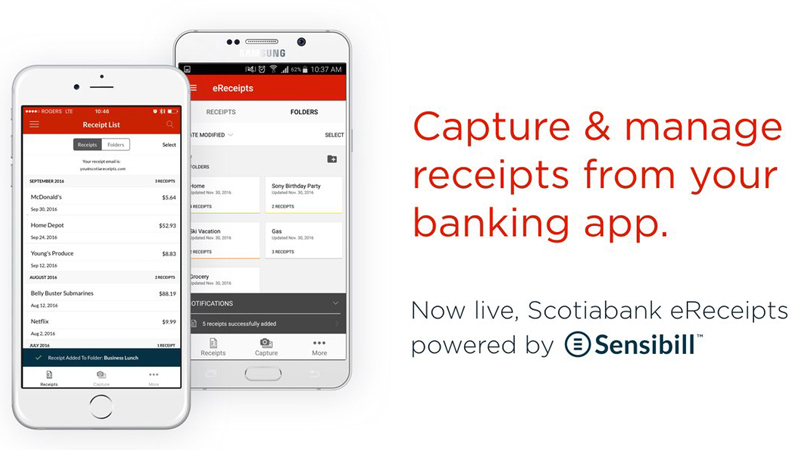

Sensibill Launches eReceipts in Partnership with Scotiabank for Receipt Management in Mobile Banking

If you dread being audited because you always forget to keep the right receipts, we’ve got news for you.

Sensibill, a white-labeled solution that allows banking customers to manage their receipts directly from desktop and mobile banking applications, has launched with Scotiabank. eReceipts, a mobile receipt management solution, is available to Scotiabank’s iOS and Android users in Canada.

“We believe eReceipts is the next killer app for mobile banking,” says Corey Gross, CEO and co-founder of Sensibill. “Receipts are cumbersome to deal with, but they’re important to save for taxes, expense tracking, returns, warranty claims, and more.”

The eReceipts add-on allows Scotiabank customers to match transactions, track expenses, capture details from paper and electronic receipts, enhance searchability, and export receipts as PDF, Excel, or CSV files.

“The launch demonstrates the willingness of financial institutions to bring the best possible experiences to their customers,” says Gross. “We strive to be a fintech that helps put Toronto on the map as a leader in financial services.” Large financial institutions seeking intuitive and simple solutions for their customers don’t always have the resources to do so in-house. Therefore, organizations like Scotiabank are partnering with fintech companies to build new, innovative services for their customers.

Sensibill, a Ryerson Futures alumni company, leverages IBM Cloud for a secure infrastructure to meet the requirements of partner banks. The service is the first to offer customers automatic matches of receipts to transaction histories, as well as the first to use machine-learning AI to break down receipts for understandability. This solution is in-line with the “mobile first” trend in banking, meant to support the need for convenience and accessibility, and a full payment experience.

“Scotiabank came to the table early and really helped us validate our ‘bank tough’ service,” says Gross. “The solution is incredibly lightweight to plug in, but packs a big punch for Scotiabank’s customers.”

And Scotiabank agrees. “Value-added services like eReceipts directly align with our commitment to provide mobile banking solutions that meet the evolving needs of our customers,” says Brian McCabe, VP of Day-to-Day Banking with Scotiabank. “We have worked to enhance Scotiabank’s My Mobile Wallet, which runs on Android devices, and our mobile banking app on iOS devices, as it supports our customers’ entire shopping experience.”

Sensibill hopes to continue with this momentum, bringing similar solutions to more users.

“Receipts is our core service, but we’re building powerful add-ons that bring additional value. We want to deliver unique solutions where item-level data can empower personal or business customers. Look forward to spending analysis tools, expense workflows, bill splitting, and more in the new year.”

To learn more, check out getsensibill.com and Scotiabank’s Mobile Wallet.